The highlights:

- Reframe your mindset to have a laser focus on the end goal. Visualize the goal, or even keep an actual picture of it.

- Life often changes on a dime—so an emergency fund isn’t just for paying for expenses. An emergency fund can provide mental and financial peace of mind.

- The act of saving can be joyful, and your goals can be attainable when you start small, stay consistent, and evaluate the difference between wants and needs.

It’s possible to earn that big weekend getaway or save for retirement while staying on track with your monthly bills, student loans, and other financial obligations. By adjusting the way you save—and think about saving—small changes can quickly accrue.

Here are five saving strategies that can help you optimize your bank account, save money on a schedule, and get closer to hitting your goal.

1. Save incrementally toward a goal you can visualize.

Say you want to buy a new smartphone and it costs $1,200. Set aside a specific amount each month—$50 or $100—until you reach the amount. For larger goals, consider opening a savings account and naming it for your specific goal, like "new car fund." Now, every time you see that account, you'll be reminded of your goal, and it'll be that much harder to justify touching that money.

2. Pay yourself first.

Paying yourself first simply means putting any incoming money into savings first. If you don’t pay yourself first, you may run into issues of overspending and derail your savings plan.

Automation is a great method to ensure you both pay yourself first and save automatically. You can set up recurring automatic transfers from your direct deposits. Your employer may offer the option to automatically deposit part of your paycheck into multiple accounts—so all you have to do is set up a savings account and watch it grow. Automating your savings can help keep you on track and feeling good about reaching your future goals.

3. Save for emergencies.

Everyone faces emergencies and unexpected expenses—but not everyone is ready to handle them financially. In fact, 27% of U.S. adults have no emergency savings.Disclosure 1

It can be beneficial to have at least three months of living expenses in an emergency-only account. If that’s not possible given your current situation, building up your savings to at least $1,000 is a great way to get started. And, if $1,000 seems out of reach, just know that any amount is better than $0, so start where you are and consistently add to it. It might not immediately feel like much, but it can help you reach your goal.

Living without an emergency fund not only can have financial implications, it can take a toll on your mental well-being too. No one wants to think about having to pay for an emergency, but they're simply a part of life. Being financially prepared can allow you to focus your mental and physical energy on getting through it, not worrying about how you’ll find the money to get through it.

4. Make small sacrifices.

People often try to follow an all-or-nothing approach when it comes to savings strategies and goals. Start by cutting back in small ways. This could be unsubscribing from some streaming services, buying generic brands instead of name brands, or even ordering water instead of a specialty drink when dining out.

Making the choice to save comes back to categorizing what we value and making a clear distinction between needs and wants.

5. Know that change is possible.

Little savings steps can lead to bigger savings steps. In other words, once you get used to saving a certain amount, you may find it easier to increase the percentage. You may also be pleasantly surprised about how exciting it can be to see your savings dollars increase.

Next step suggestions:

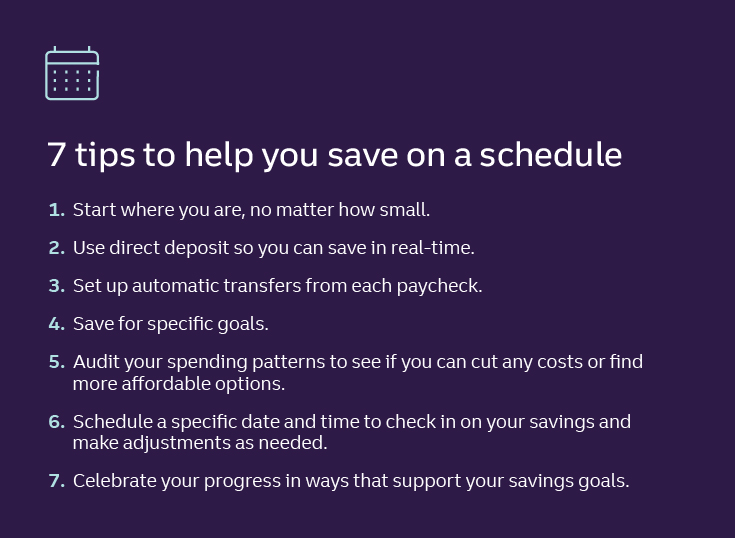

Ever heard the adage “Slow and steady wins the race”? Saving on a schedule doesn’t mean you have to make huge life changes.

- Start by making small adjustments to your financial life, like eating out only once or twice a week or making your coffee at home.

- Set up automatic transfers into a savings account.

- Try a no-spend challenge to see if you can cut out extras that aren’t bringing you as much value as your savings would.