The highlights

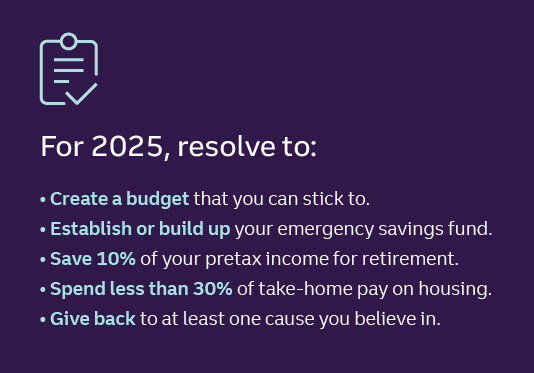

- Setting financial resolutions can help you reach your personal goals and stay motivated and inspired throughout the year.

- Some of the most common financial resolutions that can make a difference in your well-being include budgeting, building an emergency fund, paying down debt, raising your credit score, increasing your income, and saving for homeownership.

- Making room for fun and finding affordable ways to treat yourself while working toward your goals can help you stick to your resolutions.

As the year comes to a close, it’s important to look back at how the economic landscape may have impacted our lives. Inflation was still on people’s minds, as was the challenging housing market and big events like federal elections and interest rate cuts. These shifts have presented both challenges and opportunities. Now is the perfect time to reflect, refocus, and get a fresh financial start.

1. Build your emergency fund.

What will you do if you encounter an unexpected expense or loss of income? Having money set aside can help you create a financial safety net. And knowing it’s there can do wonders for your peace of mind.

Create short-term savings goals and practice saving money every week or month. Put the funds in a separate savings account, and soon enough, you’ll see you’re making progress. For a longer-term goal, aim to have at least three months’ worth of living expenses saved in your emergency account.

Make saving even easier by automatically paying yourself first with direct deposit or automatic transfer. Every little bit helps.

Read more: Grow your confidence by knowing how much to save for emergencies

2. Create a budget based on your priorities.

Have your spending or saving habits changed in the past year? Although it takes discipline, budgeting can help you find ways to afford more of the things you care about most.

The first step of budgeting is to take a good look at your spending to determine where your money is going. Then, use those insights to create a spending plan that reflects your priorities and values—and do your best to stick to the plan. While everyone’s situation is different, budgeting can help you stay on track to reach your individual financial goals.

Read more: A guide to budgeting: 4 ways to get started

3. Pay down debt and raise your credit score.

While some types of debt can be considered “good debt,” like student loans or a mortgage, you should prioritize paying off credit cards and other high-interest debt. Reducing your outstanding balances—especially credit card balances—is one of the quickest ways to improve your credit score. If you’re managing multiple debts, consider different approaches you can take to pay them down, like the snowball method or avalanche method.

Read more: 3 steps to help you ease debt stress

4. Insure yourself.

An emergency fund is a great first step to prepare for the unexpected. But making certain that you’re properly insured can be just as important. Gain a basic understanding of the fundamental types of insurance—like life, homeowners, renters, auto, flood, and disability insurance. Shop around to make sure you’re not overpaying for what you need, and work with accredited agents to get the appropriate coverage.

If your will isn’t already in place and up to date, take time this year to meet with an experienced estate planning lawyer to prepare or update your will so you can make sure your loved ones are cared for no matter what.

5. Save for retirement.

A recent national survey revealed that 67% of Americans have a retirement account, but only 34% feel like they’re financially on track for their golden years.1 For the new year, check your retirement accounts and investments. If you aren’t already investing for your retirement, research options like opening an individual retirement account (IRA) or contributing to a 401(k) through your employer. If it’s available to you, taking full advantage of employer matching on your 401(k) can have a significant impact over time.

Aim to put at least 10% of your pretax income in your retirement savings—or more if you can afford it or need to catch up. One of retirees’ most common regrets is that they didn’t start saving earlier.2

The end of the year is also an ideal time to review and rebalance your investment portfolio. This ensures your retirement accounts and investments align with your goals and risk tolerance. Diversification is key to protecting your investments from market volatility.

Read more: 5 key retirement planning tips from real retirees

6. Handle your housing expenses.

No matter if you own or rent, a general best practice is to spend no more than 30% of your take-home pay on your total housing costs. Common strategies for keeping your housing expenses in check include reducing your utility costs, shopping around for lower insurance and internet prices, or moving to a more affordable area or apartment.

The housing market has had a volatile few years, facing record low and high interest rates, low inventory, and rising prices. But no matter what the market looks like, first-time homebuyers should have a few key things covered:

- Aim for a 700 credit score or higher

- Save at least 3% for a down payment

- Build a healthy emergency fund

If you haven't hit these goals yet, consider renting in the meantime.

Read more: Want to buy a home? Key things to know

7. Take steps to increase your income.

Whether you’re currently looking for a job, hoping to score a raise, or thinking about turning a hobby into an income-generating side hustle, increasing your take-home pay is another way to improve your financial confidence and well-being. You can increase your income potential by developing your skills, seeking support services, and networking with a focus on professional relationships.

Career advancement isn’t only about negotiating a higher salary, though. While not everyone can score the job of their dreams, you can still prioritize your own happiness by aligning your career choices—like what you do or who you work for—with your personal values.

8. Remember to give back when you can.

There are so many reasons to give back—and there’s science that says giving can be good for your health.3 In the coming year, make giving back one of your goals. There are plenty of ways to keep paying it forward year-round, whether it’s a charitable donation or sharing your time, talents, and resources to support your local community. Ask a friend or family member to get involved, which can make giving back a bonding experience with those who are important to you.

9. Make room for fun.

While hitting financial goals can be rewarding, saving for retirement or paying down debt aren't most people's typical idea of "fun." Incorporating goals that support your happiness and bring you joy can be just as important as your more practical goals. This can include saving for a new TV, taking a vacation, or finally putting in that backyard swing set for the kids.

If you’re on track with your other savings goals, budgeting for something you want, but maybe don’t need, can be a great way to keep you motivated and reward yourself for making progress toward your most important goals.

10. Tend to your mental well-being.

Fitness goals are common resolutions—but your mental health can be just as important as your physical health. Among adults who report high stress levels, money is one of the most common causes.4 By taking control of your finances, you're caring for your mental health. Before and after the new year, take some time to rest and recharge. There are lots of ways to take care of your mental well-being. Talk to a therapist if one is available to you, or chat with a friend or family member you trust. Take a few minutes for your mental health each day—going for a walk, meditating, or sipping coffee or tea on your porch with no distractions can all be beneficial for the mind.

While this coming year will look different for everyone, the more of these tips you follow, the more confidence you can gain. Even focusing on just one or two of these financial resolutions for the year can help relieve stress and get you closer to your goals.

11. Make sure you stay on track.

Setting financial resolutions is a great way to start the year. But sticking to them is easier said than done. One way to stay on course is to write down your financial resolutions and other goals you hope to achieve in the coming months.

Referring back to them down the road can help you stay motivated and on track. You can also stay on top of your goals by creating routine check-ins, including setting weekly or monthly reminders to review your budget. Continually monitor your progress and celebrate how far you’ve come.

Next steps:

- Want more help figuring out your financial resolutions for the new year? Try listening to this podcast that features bestselling author Caroline Adams Miller, an expert on goals and happiness.

- Use our savings goal calculator to figure out just how much you need to save each month to reach your goals by year-end.

- Be flexible. Life is unpredictable, but writing down your goals and creating a routine can help you stay on track.

Saving feels good with Truist One Savings.5

There are four ways to waive the monthly maintenance fee. There’s a lot to love about Truist One Savings.