Investing for beginners starts with getting to know fundamental investing concepts and how they can apply to your financial life. Even though we can’t know exactly how different investments will perform in the future, we can have more confidence by understanding how the market works. Learning investing lingo can help take away the intimidation factor and build the confidence you need to start developing a solid investing strategy.

“Knowledge is power,” says Bright Dickson, Truist’s resident expert on happiness and co-host of the Money and Mindset With Bright and Brian podcast. “Knowing more about investing allows you to take intentional action and have more control.”

The highlights

- You don’t have to learn every term, phrase, or concept to successfully invest for your future. But knowing some of the basics can go a long way toward becoming a confident investor.

- Understanding some of the common types of investments—like stocks, bonds, and mutual funds—and key concepts like compounding and diversification are some of the most important investing terms to grasp.

- The more we know and do, the more our financial confidence grows, which has a direct impact on our well-being.

“Investing can seem intimidating, especially when you’re just getting started. But many of the reasons we don’t invest aren’t good enough to hold us back from starting. And by not investing, it’s difficult to achieve our full financial potential.”

–Brian Ford, Head of Financial Wellness, Truist

When it comes to investing for beginners, here are terms everyone should know, starting with a few basics:

Common types of investments

Stocks:

When a company is publicly traded, shares of the company are offered to investors—and pretty much anyone is eligible to purchase those shares. When you invest your money in one or more shares of a company, it’s commonly referred to as “buying stock.” If you buy shares of company, you own stock, which represents owning a small percentage of that company.

An important investing tip for beginners: The current value of a stock represents a market-based estimate of the current value of the company. Stock prices can go up or down based on predictions about where a company is headed in terms of profitability, but they’re not guarantees of the outcomes.

Bonds:

When you buy bonds, you’re actually lending money to an entity for a typically small, fixed return over a specific period of time. While the returns on bonds are typically small, they’re easily predictable, unlike the returns on stocks. Bonds can be offered by governments and corporations alike as a means to raise money.

Mutual funds:

A mutual fund is a collection of stocks, bonds, or other types of investments. Most mutual funds are actively managed—meaning there’s a team of professional investors actively buying or selling the assets that make up the mutual fund in an effort to keep it balanced and on track with the fund’s goals. In exchange for this hands-on professional management, investors who buy mutual funds pay a management fee, which is typically represented as a percentage of your total investment. You can see this reflected in a fund’s “expense ratio,” which is an estimate of the overall cost of investing in a fund. For actively managed funds, an expense ratio of 0.5% to 0.75% is typically considered normal, while anything higher than 1.5% could be considered high.Disclosure 1

Just as there are many different types of investments, there are many different types of mutual funds. Some, for example, track major indexes like the S&P 500, Dow Jones Industrial Average (DJIA), or Nasdaq and invest in the companies that those indexes follow (more on these indexes below). Others may invest according to a specific theme, like clean energy, technology, or real estate.

ETFs:

Short for exchange-traded funds, ETFs have become one of the most popular ways to invest today. Like mutual funds, ETFs invest in a basket of stocks, bonds, or other assets—so if you buy one share of an ETF, you’re typically buying a small percentage of dozens, hundreds, or even thousands of different companies or assets. ETFs can also be actively or passively managed. Actively managed ETFs typically charge a higher management fee, but ETFs are known for having lower expense ratios than mutual funds in general. Because a fund’s fees can impact your overall returns over time, this is part of the reason ETFs attract investors.

Partial stock:

Also known as a fractional share, a partial stock is a part of one full share. Partial stocks provide a way for investors to own part of a stock that may otherwise be unaffordable. For example, let’s say you want to purchase a share of a well-known company and it trades at $900+ per share, which is too much for your budget. If your brokerage account allows you to buy fractional shares, you could purchase just a portion of one share for a portion of the cost.

General investing concepts

Portfolio:

Your portfolio is your collection of investments. It can include a mix of stocks, bonds, cash, and other types of investments like commodities (for example, gold or silver) or even cryptocurrencies (such as bitcoin).

Asset mix:

The types of investments that make up your portfolio and the weight of each investment is often referred to as your asset mix. For example, your portfolio could consist of a mix of 70% stocks and 30% bonds.

If you’re an investor with many years for your investments to grow, you can still be diversified with an asset mix consisting mostly of stocks. But for a more conservative approach, you may consider an asset mix that favors bonds, which have more predictable outcomes.

Diversification:

Speaking of asset mixes and being diversified, diversification in investing refers to the idea of not putting too much money into the same investment, like one specific stock. “Don’t put all your eggs in one basket” is a common phrase in the world of financial advising—and when people say it, they mean to diversify. If done properly, this can help mitigate some of the risk of investing for beginners—if one stock in your portfolio underperforms, it’s only a small percentage of your total investments. Plus, economic events that can cause some stocks to decline may sometimes cause other stocks to rise.

Compounding:

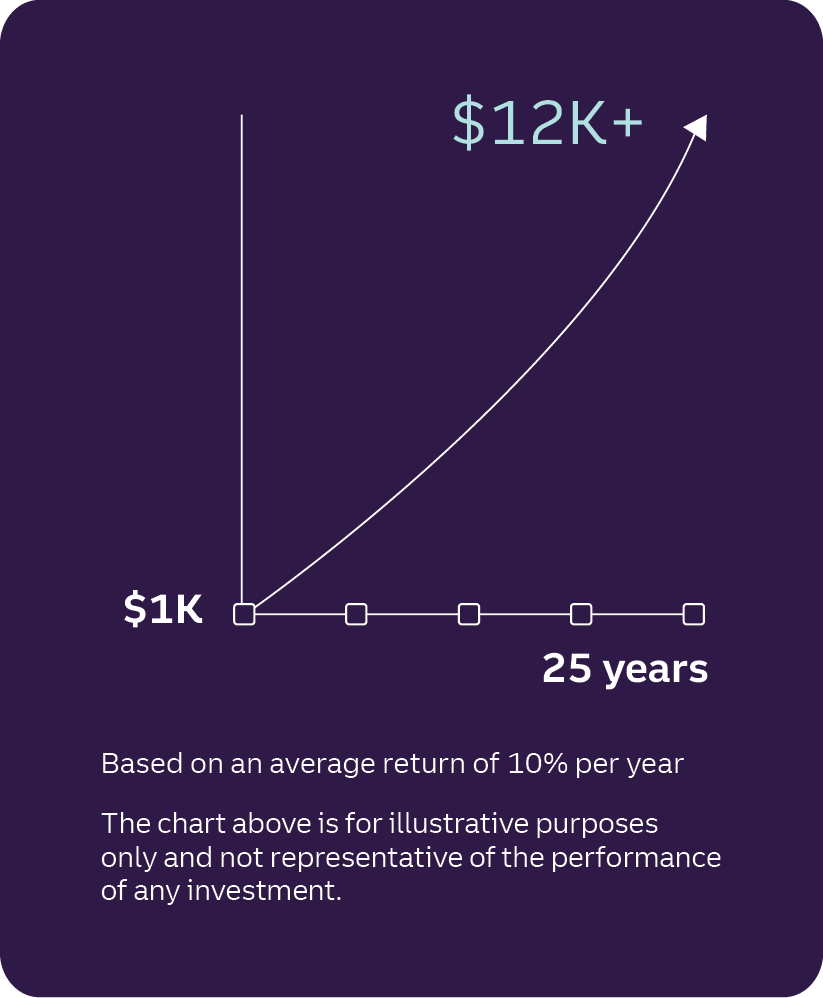

If you earn 5% on an investment over the course of a year and keep your earnings invested, earning 5% the next year will mean even more. Over a long period of time, this concept can prove powerful for your finances—and it’s a concept Brian Ford, Truist’s head of financial wellness, says is crucial for saving for retirement.

“If you were to save 10% of your income for 30 years without earnings, how many years of income will you have saved? Only three,” he says. “The point is, it’s difficult to save your way to retirement without investing—we need the power of compound interest over time.”

To illustrate the power of compound interest, let’s say you start with $10,000 and assume you earn a constant 5% on that investment each year. After one year, you’ll earn $500 and have $10,500 invested. That second year, you’ll earn $525 instead of just $500. The more years the investment has to grow, the bigger the difference this can make—over 20 years at that same rate, your $10,000 investment would turn into more than $27,000. And that’s if you didn’t make any additional contributions.

Dividends:

Many, but not all, publicly traded companies offer their investors payments in the form of dividends. Dividends are often paid quarterly but can be paid at different intervals, like monthly or semiannually. Investing in companies that offer dividends can be a good way to diversify your portfolio or build passive income because a stock can pay dividends whether the value of the stock goes up or down. It can also be a great way to grow your portfolio over time because you can use dividends to buy more stocks by automatically reinvesting them.

Retirement accounts

401(k): If you’re a full-time employee, there’s a good chance you have access to an employer-sponsored 401(k) retirement savings plan, which is what many companies offer today in place of pension plans.

A 401(k) allows you to invest part of every paycheck—before taxes are taken out—to gradually build your retirement savings. Many employers also offer additional 401(k) benefits, like matching up to a certain percentage of your contributions.

Retirement accounts like a 401(k) or IRA are often called “tax-advantaged” because—unlike a personal brokerage account—your investments grow tax-free. With a traditional 401(k) or IRA, however, you may, depending on your income tax bracket at the time, pay income tax on your withdrawals after you retire, and (unless certain exceptions apply) additional taxes may be imposed if you withdraw funds prior to age 59 ½.

IRA:

Similar to a 401(k), an Individual Retirement Account (IRA) is the retirement savings vehicle of choice for many Americans—more than 40% of U.S. households have one.Disclosure 2 Anyone can open an IRA to save for retirement—you don’t need to go through an employer to start investing in one. And like a 401(k), your IRA contributions grow on a tax-deferred (traditional IRA) or tax-free (Roth IRA) basis.

With a traditional or Roth IRA from Truist, you can invest for retirement and choose from self-directed trading, automated investing, or getting guidance from a financial advisor.

Roth:

A concept introduced in 1997 and named after Senator William Roth, a Roth IRA or Roth 401(k) is simply another option for retirement accounts in which you go ahead and pay taxes on your contributions. The potential advantage of a Roth account? Your investments still grow tax-free, and you don’t have to pay taxes on your withdrawals in retirement, including any growth in the amounts you contributed to your Roth IRA.

While nobody can predict the future, some financial pros argue that your income tax rate in the future could be higher than your income tax rate today, which is why some retirement savers opt for a Roth account. Some savers even choose to invest in both a Roth account and a traditional account.

Contribution limits:

The IRS maintains annual contribution limits on retirement accounts, although most retirement savers do not hit these limits. Contribution limits sometimes change from year to year, but you can always get the latest information from your retirement plan provider, the IRS, or a tax professional.

Check out: Retirement savings calculator

Major market indexes

S&P 500:

Since the inception of the U.S. stock market, a few different tracking indexes have been created as a way to gauge the health of the market. One of the most commonly used indexes today is the Standard & Poor’s 500 Index (S&P 500), which tracks and measures the performance of the 500 largest publicly traded companies in the U.S. Since 1957, the average return of the S&P 500 has been more than 10% each year.Disclosure 2

Many retirement savings plans can be invested in a fund that closely tracks the S&P 500, but you can also invest outside of your retirement plan by purchasing a fund that tracks the S&P 500. In doing so, you’re essentially buying a small stake in each company in the S&P 500 with each share. That means you’re also automatically getting a diversified stock portfolio.

DJIA:

The Dow Jones Industrial Average, commonly referred to as the Dow, is another major U.S. stock market index; however, it focuses on just 30 large publicly traded companies. Even older than the S&P 500, the DJIA was publicly introduced in 1896. Between2004 and 2024, it gained about 6.7% annually.Disclosure 3

Nasdaq:

Nasdaq stands for the National Association of Securities Dealers Automated Quotations, which was the first electronic market for buying and selling stocks. However, the term Nasdaq is more commonly used to refer to the Nasdaq Composite Index, which is perhaps the third most-known U.S. stock market index. Even bigger than the S&P, the Nasdaq index tracks more than 3,300 stocks. Over the last 15 years, this index has seen average annual returns of more than 10%.Disclosure 4

Starting to feel like you know a bit more about the world of investing? Like Dickson says—knowledge is power. So, take this newfound knowledge and look for ways to apply it toward your own financial goals.

Next steps

- If you’re not already investing, consider starting by funding a tax-advantaged retirement account. Investing in an IRA or 401(k) can be a simple, powerful step toward building financial confidence.

- If you’re investing for retirement but want to explore new ways to invest, check out our other investing products.

- Keep learning! You can find more investing tips by checking out our investing content collection or our podcast.