Picture this: You’ve built up your emergency savings, you’re in control of your debt, and you just put $1,000 in the bank. Investing that extra money may sound like a great idea, but where should you start?

While investing always involves some risk, these tips and insights are based on time-tested practices that can help you decide how to invest your hard-earned money. And according to one popular saying, “Time in the market beats timing the market.” In other words, the best time to start investing is now.

The highlights:

- Investing even small sums consistently can help your money grow over time. And typically, the sooner you start, the better.

- Setting clear financial goals, like saving for retirement or a down payment on a house, and a time horizon can help you decide how to invest $1,000.

- You can consider a variety of investment types and assets based on your goals, how soon you’ll need the money, and your risk tolerance.

Understand the power of $1,000.

If you’re thinking about retirement or a major purchase, like a new car, $1,000 may seem like a drop in the bucket. If you invest it, however, its growth potential over time can be substantial—and that’s thanks in part to the power of compound interest.

Here’s how compounding works. When you invest money, you may earn interest, or the values of the investment may change over time, depending on the type of investment. Any gains can be reinvested, or in the case of a stock going up in value, they’re simply added to the overall value of your investment. In other words, by staying invested, you can earn interest on all the other interest you’ve earned before. Or, in the case of stocks, you’re earning gains on top of your earlier gains.

Let’s say you invest $1,000 in an index fund with an average annual return of 10%. That investment could grow to about $1,100 after just one year. But if you didn’t touch it for 25 years and let it continue compounding, it would grow to more than $12,000 at that rate, even with no additional contributions.

If you continued to invest an additional $100 a month in that fund over those 25 years and got the same return rate, your investments could grow to more than $145,000.

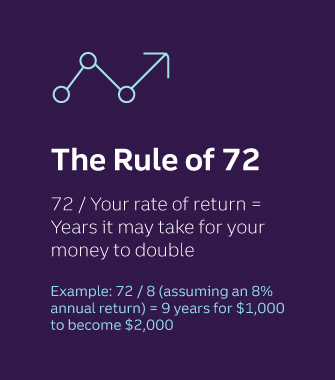

Another way to think about the potential growth investment can bring is by using the Rule of 72.

“It’s basically the length of time it takes for an investment to double, and it’s a pretty simple calculation,” says Brian Ford, Truist head of financial wellness. “You’re dividing 72 by your rate of return—let’s say 8%, which is around an average annual stock market gain. For example, you simply take 72 divided by eight, which equals nine, so your $1,000 is going to double in nine years.”

So don’t underestimate the power of a $1,000 investment!

3 concepts that can help you confidently invest $1,000

- Diversification: This means spreading your money across different assets to mitigate risk. You could diversify by investing in mutual funds (more on these below) or by owning a mix of individual stocks, bonds, or other types of assets. The poor performance of any one investment can potentially be offset by the performance of other assets in your portfolio. It’s about not putting too many eggs in one basket.

2. Dollar-cost averaging: This is the principle behind a popular investment strategy where you invest at regular intervals. It can take away the guesswork of trying to “time the market,” which the vast majority of investors can’t do, and help your investments weather the ups and downs of the market. Making automatic contributions from your paycheck to a 401(k) is one common example of dollar-cost averaging. You can apply the same strategy to a brokerage account.

3. Risk tolerance: This refers to your willingness to endure loss or fluctuations in your investment portfolio. If your risk tolerance is low, you may prefer a more conservative investing approach that prioritizes stability, even if it means potentially missing out on higher returns in the long term. Your risk tolerance may vary depending on the time horizon of your investment goals—more on that below as well.

| Investing age | Initial investment | Total at age 60, assuming 8% return compounded monthly | Total at age 60 if you continue to add $1,000 annually |

|---|---|---|---|

| 20 | $1,000 | $24,273.39 | $304,677.29 |

| 30 | $1,000 | $4,927.80 | $52,238.96 |

| 40 | $1,000 | $4,927.80 | $52,238.96 |

| 50 | $1,000 | $2,220.64 | $16,914.19 |

Figure out your goals and time horizon.

- Before investing, think about how you’ll eventually use your money. “All investments should have a purpose,” Ford says. “A goal of ‘making more money’ is not investing. Everyone wants to make more money. Are you saving for a house? Creating an emergency fund? Saving for retirement? Then you can start to talk about your time horizon.”

- A time horizon refers to how long you plan to hold an investment for a particular goal, and it’s an important part of deciding where to put your money. A longer time horizon typically means you can invest more aggressively, Ford says, as time in the market can help mitigate short-term risks. As you get closer to your investment goals, you may want to rebalance your portfolio with a more conservative mix of investments.

Consider these three time-horizon examples:

- Short-term (0 to 3 years): If you’re building up your emergency savings or working toward a down payment on a car you hope to buy soon, you may want to avoid risky investments entirely and consider using a money market fund, savings account, or CDs (certificates of deposit). These come with less risk and can provide you with easier or more predictable access to your cash for when you need it. With a Truist One Savings1 account, you can continue earning interest while building toward your short-term goals. We also offer CDs as a means to help you save and invest.

- Medium-term (3 to 10 years): For bigger goals like saving for college or a down payment on a house, you may want to consider an investment account with a balanced mix of assets and some moderate risk.

- Long-term (10+ years): If you’re investing for retirement, a 401(k) or Individual Retirement Account (IRA) can offer considerable tax benefits. A 401(k) is typically offered through your employer, sometimes with a matching contribution, while anyone earning an income can open an IRA. Depending on your risk tolerance, you can consider filling your portfolio with a more aggressive mix of assets. There are annual limitations on how much you can contribute to these retirement savings accounts—in 2024, it’s $23,000 for 401(k)s and $7,000 for IRAs.Disclosure 2

“All investments should have a purpose.” —Brian Ford, Truist head of financial wellness

Explore different types of investments.

Settled on a time horizon? Whether you’re picking your own investments, managing your 401(k), or working with a financial advisor, it can help to know a little more about some of the different ways to invest $1,000. Here are some common examples:

- Index funds: An index fund invests in the companies tracked by one of the major market indexes, like the S&P 500, which tracks the 500 largest companies in the U.S. and has an average annual return of about 10% over time.Disclosure 3 Investing in an S&P 500 index fund can help diversify your portfolio by tying your investments to many different companies’ performance.

- Exchange-traded funds (ETFs): When you buy a share of an ETF, you’re buying a bundle of stocks (or bonds) that can be traded just like individual stocks. With an ETF, you’re buying a small percentage of many different companies, which is an easy way to diversify. Some ETFs also function as index funds, while others may focus on a market “theme,” like technology or energy.

- Mutual funds: Similar to an ETF, a mutual fund allows many people to pool their money to buy a variety of stocks, bonds, or other assets. It’s typically managed by a team of professional investors. Index funds, ETFs, and mutual funds can all be great for easily diversifying a $1,000 investment.

- Target-date funds: Commonly used in 401(k) plans and other retirement savings accounts, these funds are managed by professionals to grow more conservative as you get closer to your retirement date. They can be a good option for retirement investors with a “set-it-and-forget-it” mindset.

- Individual stocks: Buying shares of ownership in specific public companies can be significantly riskier than buying into mutual funds and ETFs. Picking stocks wisely requires a much more hands-on investing approach. It’s important to do your research and understand the risks if you take this route.

- Bonds: Generally considered to be less risky than stocks, bonds are like loans from an investor (you) to a borrower—typically a company, government, or municipality. Bonds provide a fixed income return, and you get your money back as the bond matures after a set amount of time.

Figuring out how to invest $1,000 can be a great way to make progress toward your financial goals. If you’re not investing, the key is just to start. If you are investing, keep it up! By having patience and continuing to learn about investing, your money may compound and grow, setting you up for financial success in the future.

Next step suggestions:

- Does your employer offer a 401(k) plan with matching contributions? If you’re not sure, find out—this can be a great way to start investing for retirement.

- Why stop with $1,000? Automate your savings to put 15% or more of your monthly income into a retirement or investment account.