Commercial checking solutions

Your company’s needs are unique. Expand your capabilities with better checking solutions.

Let’s manage your business, government, or nonprofit finances with an account that’s customized for your organization.

Commercial checking resources

Maximize your company’s efficiency and earning power.

Improve your company’s cash flow and make the most of every opportunity.

Abundant checking solutions

Whether you’re well established or looking for ways to expand—each account is uniquely designed to serve your company’s best interests.

Unique features

Choose the checking account that fits your business. Capitalize on options for low fees or interest-earning potential.

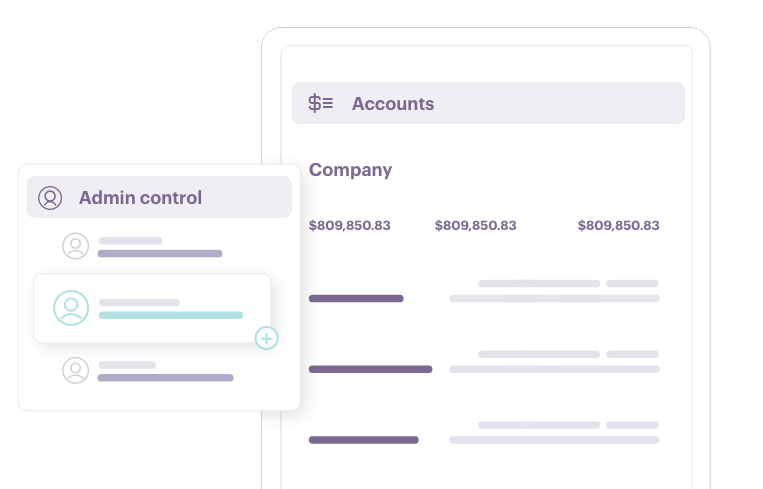

Better tools

Enjoy customizable solutions to help your company with everyday banking—and with meeting long-term goals.

Commercial checking accounts

Find the right checking account for your business.

Analyzed Checking

Optimize your company’s financial performance and reduce—or eliminate—service charges with a competitive earnings credit rate.

Model : "stack"

Position : "left"

Account benefits

- Reduce or eliminate service charges through an earnings credit.Disclosure 6

- Group multiple Analyzed Checking accounts to allow a consolidated analysis of balances and services.

- Receive a no-fee, monthly analysis statement, including detailed information regarding checking and treasury management services separate from your deposit statement.

Best fit if you

- Are a business with high checking balances, high transaction volumes, and advanced treasury management needs that wants an earnings credit on balances to reduce or eliminate service charges.

See our Commercial Bank Services Agreement (PDF) for more information.

See our Deposit Fee Schedule (PDF) for more information about your account.

Questions about Analyzed Checking? Contact your relationship manager or call us at 844-4TRUIST (844-487-8478) for more information or to open an account.

Questions about Analyzed Checking? Contact your relationship manager or call us at 844-4TRUIST (844-487-8478) for more information or to open an account.

Analyzed Interest Checking

Optimize your company’s financial performance and reduce—or eliminate—service charges with a competitive earnings credit rate. Plus, earn interest on your excess balances.

Model : "stack"

Position : "left"

Account benefits

- Earn interest on excess balances above those needed to offset service charges.

- Reduce or eliminate service charges through an earnings credit.Disclosure 6

- Group multiple Analyzed Interest Checking accounts to allow a consolidated analysis of balances and services to reduce or eliminate certain service costs.

- Receive a no-fee, monthly analysis statement, including detailed information regarding checking and treasury management services, separate from your deposit statement.

Best fit if you

- Are a business with high checking balances, high transaction volumes, and advanced treasury management needs that wants an earning credit on balances to reduce or eliminate service charges—and to earn interest on excess balances.

See our Commercial Bank Services Agreement (PDF) for more information.

See our Deposit Fee Schedule (PDF) for more information about your account.

Questions about Analyzed Interest Checking? Contact your relationship manager or call us at 844-4TRUIST (844-487-8478) for more information or to open an account.

Commercial Interest Checking

The convenience of a traditional checking account. Combined with more interest earning potential.

Model : "stack"

Position : "left"

Account benefits

- Get competitive interest rates, compounded daily.

- Receive a no-fee, monthly analysis statement, including detailed information regarding checking and treasury management services, separate from your deposit statement.

Best fit if you

- Are a medium to large business or non-profit that needs easy access to funds and the ability to maximize your interest income.

See our Commercial Bank Services Agreement (PDF) for more information.

See our Deposit Fee Schedule (PDF) for more information about your account.

Questions about Commercial Interest Checking? Contact your relationship manager or call us at 844-4TRUIST (844-487-8478) for more information or to open an account.

Analyzed Checking

Analyzed Checking

Optimize your company’s financial performance and reduce—or eliminate—service charges with a competitive earnings credit rate.

Model : "stack"

Position : "left"

Account benefits

- Reduce or eliminate service charges through an earnings credit.Disclosure 6

- Group multiple Analyzed Checking accounts to allow a consolidated analysis of balances and services.

- Receive a no-fee, monthly analysis statement, including detailed information regarding checking and treasury management services separate from your deposit statement.

Best fit if you

- Are a business with high checking balances, high transaction volumes, and advanced treasury management needs that wants an earnings credit on balances to reduce or eliminate service charges.

See our Commercial Bank Services Agreement (PDF) for more information.

See our Deposit Fee Schedule (PDF) for more information about your account.

Questions about Analyzed Checking? Contact your relationship manager or call us at 844-4TRUIST (844-487-8478) for more information or to open an account.

Questions about Analyzed Checking? Contact your relationship manager or call us at 844-4TRUIST (844-487-8478) for more information or to open an account.

Analyzed Interest Checking

Analyzed Interest Checking

Optimize your company’s financial performance and reduce—or eliminate—service charges with a competitive earnings credit rate. Plus, earn interest on your excess balances.

Model : "stack"

Position : "left"

Account benefits

- Earn interest on excess balances above those needed to offset service charges.

- Reduce or eliminate service charges through an earnings credit.Disclosure 6

- Group multiple Analyzed Interest Checking accounts to allow a consolidated analysis of balances and services to reduce or eliminate certain service costs.

- Receive a no-fee, monthly analysis statement, including detailed information regarding checking and treasury management services, separate from your deposit statement.

Best fit if you

- Are a business with high checking balances, high transaction volumes, and advanced treasury management needs that wants an earning credit on balances to reduce or eliminate service charges—and to earn interest on excess balances.

See our Commercial Bank Services Agreement (PDF) for more information.

See our Deposit Fee Schedule (PDF) for more information about your account.

Questions about Analyzed Interest Checking? Contact your relationship manager or call us at 844-4TRUIST (844-487-8478) for more information or to open an account.

Commercial Interest Checking

Commercial Interest Checking

The convenience of a traditional checking account. Combined with more interest earning potential.

Model : "stack"

Position : "left"

Account benefits

- Get competitive interest rates, compounded daily.

- Receive a no-fee, monthly analysis statement, including detailed information regarding checking and treasury management services, separate from your deposit statement.

Best fit if you

- Are a medium to large business or non-profit that needs easy access to funds and the ability to maximize your interest income.

See our Commercial Bank Services Agreement (PDF) for more information.

See our Deposit Fee Schedule (PDF) for more information about your account.

Questions about Commercial Interest Checking? Contact your relationship manager or call us at 844-4TRUIST (844-487-8478) for more information or to open an account.

Looking for simpler checking account options?

We have other checking solutions for your company.

Truist One View

The digital services you rely on—wrapped into one place.

Taking care of your accounts should be simple. Truist One View gives you access to multiple banking applications—without multiple sets of sign in credentials—all from one place.

Business Resource Center

Want some fresh ideas?

Expand your knowledge with resources for a better business strategy. Stay up to date with trending topics, news, and research.

Stay informed and get connected

Looking for fresh thinking and new insights to help uncover opportunities for your business needs?

Connect with a Relationship Manager

Work with a partner who sees your vision and has the resources to help you achieve it. We’re ready to focus on the specific needs of your company—and where you are in your business lifecycle.

Existing Truist clients are encouraged to contact their relationship managers with inquiries related to commercial products and services.