Building a team can be time-consuming for business leaders and owners, who often are busy with the day-to-day operations of their company. That’s why your Truist relationship manager does the legwork for you.

Truist Business Lifecycle Advisory begins with your relationship manager getting to know you and your unique needs and goals for the future. Their next step is to bring in partners to help make your vision come to life.

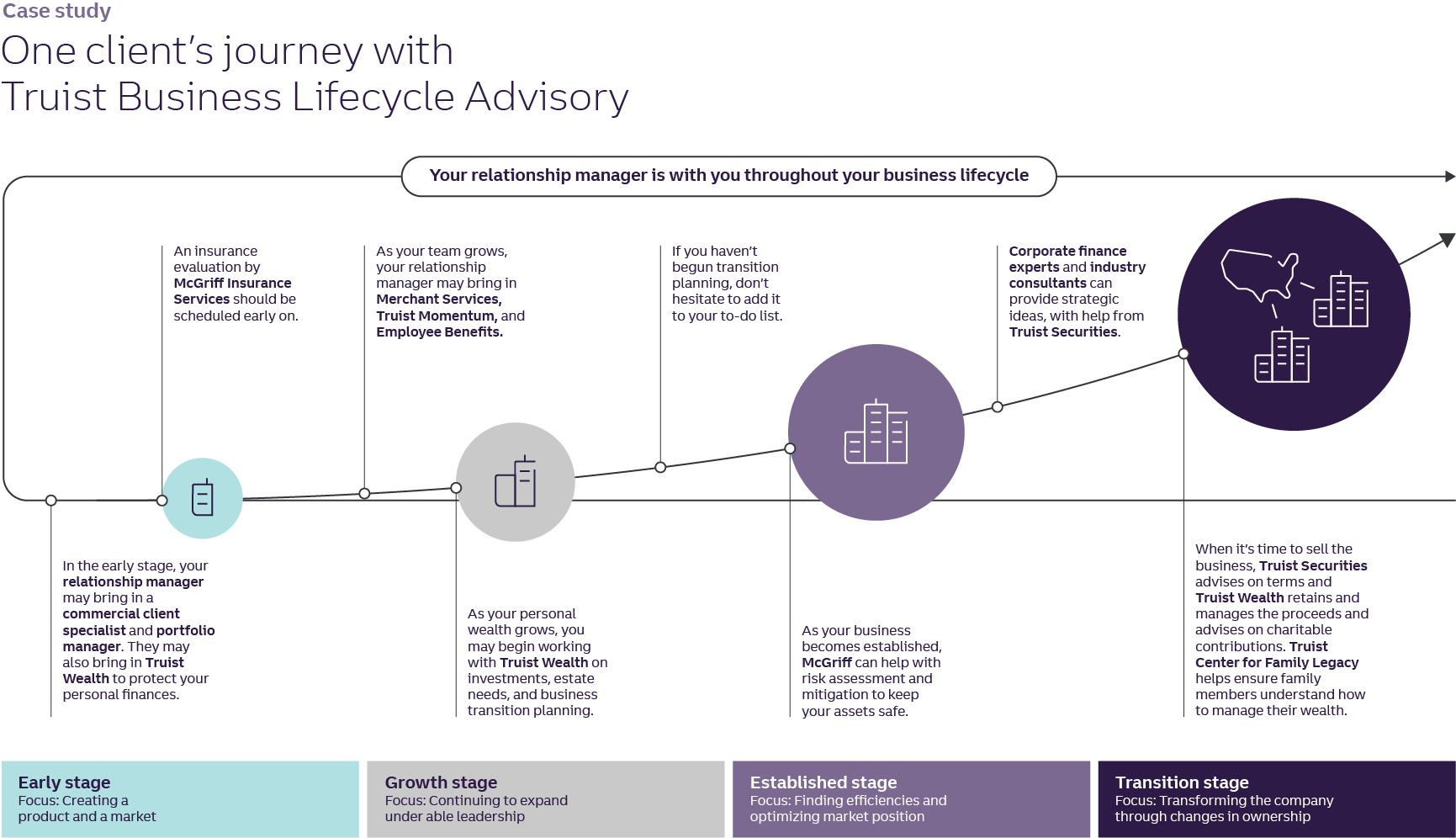

As your business progresses through the business lifecycle, your needs will evolve—and the team assembled by your relationship manager will evolve to meet them. [See the chart below for an example of how the process may look for you.]

“At any given point in time, we’re showing up as one team to troubleshoot on behalf of your business,” says David Weaver, head of Truist Commercial Banking. “A business leader doesn’t care what it says on my business card, and they don’t have time to go searching for the right advice. They care about making smart moves that set them up for success now and in the future. So that’s what we care about too.”

Read on to learn more about the teammates and partners your relationship manager may bring in throughout the business lifecycle—and what they can help you achieve.

Truist relationship manager: One call brings you the whole team.

Your Truist relationship manager will be your main point of contact at Truist, and they’ll be your steady partner from week to week, year to year, and stage to stage. When you first meet, your relationship manager will ask questions to understand you and your business. That includes your business lifecycle stage, existing financial plan, and professional and personal goals.

“For example, if a relationship manager hears their client’s having a cash flow issue or a payments issue, they bring in their merchant services or treasury solutions teammates,” says Weaver. “We’ve got all the products and services required to make a business owner’s life a little bit easier, both from a banking perspective and a leadership perspective. It’s our job to bring you the team you need so you can keep your eye on the ball.”

Some relationship managers are also specialists in a particular industry, such as food and agribusiness, education, healthcare, building products, or waste management. Learn more in “The value of industry specialization in business lifecycle advisory.”

Here are some of the goals your Truist relationship manager can help you meet—and the teammates they’ll bring in to help—over the course of your work together.

“We’ve got all the products and services required to make a business owner’s life a little bit easier, both from a banking perspective and a leadership perspective. It’s our job to bring you the team you need so you can keep your eye on the ball.”

David Weaver, Head of Truist Commercial Banking

Optimize finances and operations.

Commercial client specialist: Get day-to-day support on common transactions.

Your business accounts should align with your long-term plan and values. That’s where your commercial client specialist comes in, helping manage the day-to-day details of your financial plan to adapt quickly as your needs change. They also stay in close contact with your Truist relationship manager, keeping them up to date on anything that can impact their strategic advice.

Portfolio manager: Access credit to keep cash flow strong.

This Truist partner is focused on everything related to lending. They’ll assess and address your immediate and long-term needs to ensure you have the funding required to implement your strategic plan. They can help you access capital for seasonal, short-term, and unexpected cash flow needs. They’ll assist you in finding financing for inventory, growth, or expansion—and connect you with lending specialists for equipment or commercial real estate purchases. They’ll also inform you of industry trends and potential credit issues common to your business lifecycle stage—and provide proactive and timely solutions.

Wholesale payments team: Transform your payables and receivables experience.

Truist’s wholesale payments business encompasses treasury solutions, merchant services, and commercial credit card solutions.

- Your treasury consultant provides guidance to optimize your payables, receivables, sweep, information reporting, and digital banking. They’ll support your treasury requests, respond to and resolve general technical issues, and help you find solutions to service-related challenges. They’ll also provide education around digital services and key procedures, identify ways to improve internal processes, and help you meet or exceed key metrics or indicators related to performance and risk.

- Your merchant services specialist will help you transform your customers’ buying experience. Truist Merchant Services offers payment processing solutions that simplify the checkout process and give you quicker access to capital. They also simplify accounting and can provide you with reporting and data insights that can enable you to pivot more quickly.

Protect your operations and support your employees.

McGriff Insurance Services: A national broker with a client-centric approach.

If you’re looking for some extra peace of mind for yourself or your business, our team at McGriff Insurance Services can help with a broad range of brokerage and risk management services to help keep your assets—and your business’s assets—safe.

- McGriff business insurance solutions include auto and transportation, bonding and surety services, commercial flood, commercial liability, commercial property, cyber liability, executive risk advisors, international, succession planning, trade credit, transactional risk, and workers’ compensation.

- Truist Life Insurance Services are also available to protect your family, income, retirement, business, and more.

- Employee benefits play an important role in employee acquisition and retention. In addition to core consulting and brokerage services, McGriff offers benefits administration technology, COBRA administration, flexible benefits (like HSAs), human resources advisory consulting, pharmacy benefit consulting, retirement consulting, and more.

Truist Momentum: An employee benefit that adds value

When considering employee benefits for your company, your relationship manager can also introduce you to Truist Momentum. This financial wellness program inspires, educates, and equips employees to manage their money. How they do that will be based on employees’ individual needs, goals, and personal lifecycle stage (whether they’re graduating from school, starting a family, buying a home, or looking forward to another major milestone).

Truist Leadership Institute: Find science-based solutions to real-world challenges.

Many times, business owners don’t seek out specialized leadership training until they’ve been managing people for many years. Learning how to be a thoughtful leader can help inspire innovation and positive change at every stage of the business lifecycle. It can also help you attract and retain top talent. Truist Leadership Institute’s programs and services take a science-based approach to leadership development. And they’re personalized to the unique needs of your business and your team. Truist Leadership Institute also offers guidance in change management and employee engagement.

Protect your personal wealth and legacy.

Truist Wealth advisors: Build a powerful personal portfolio.

Your personal history, past decisions, current situation, and future goals all come into play when making informed decisions about your personal and family wealth. As your business grows and progresses through the business lifecycle, your private accounts should, too.

At Truist, your wealth advisor will play much the same role as your relationship manager—with a focus on your personal financial needs. They can bring together a team of experts in areas such as personal and family investments, insurance, legacy planning, generational financial education, corporate trust and escrow services, and foundations and endowments.

The Truist Center for Family Legacy, along with your Truist Wealth advisory team, can provide the resources, insights, and tools you need to sustain your family’s wealth—so future generations can continue to evolve what you’ve begun.

Truist business transition advisors: Helping you plan your exit—and your future.

Once you have your business up and running, we’re here to make sure your success continues. Our Business Transition Advisory Group can walk you through each step of transitioning your business. Business transitions may include any major change—in leadership, ownership, financing, market strategy, location, and so on—each with its own challenges and opportunities. Your Truist Strategic Client Group will include accounting, legal, financial, M&A (mergers and acquisitions), and other advisors who can help you achieve the best possible outcome for you, your family, your employees, your clients, and your community. They will be there for you before, during, and after the transition.

Because business transitions can happen at any time, sometimes unexpectedly, your Truist relationship manager will bring up this topic even if you’re not planning on selling or transitioning your business soon.

Inspire and build better lives and communities.

External partnerships: Community connections benefit everyone involved.

Truist’s purpose is to inspire and build better lives and communities. This goes hand in hand with another Truist principle—to deliver product-agnostic advice. What does that mean? When you need a solution, we’ll help you find it, even when that means introducing you to external partners.

Because our relationship managers have strong ties to the community, they have often helped clients make local connections with accountants, general contractors, lawyers, and other business professionals.

Truist also created many Commercial Advisory Boards consisting of local business leaders who provide regular feedback on emerging issues—and let us know how we can make a difference in their community’s future.

External partnerships also exemplify the long-term view that Truist Business Lifecycle Advisory takes of your business, its success, and its impact. Asking questions, listening closely, adapting swiftly, and providing holistic solutions is what our lifecycle advisory is all about. With strong relationships inside and outside of Truist, the community benefits multiply.

What business lifecycle advice can benefit you right now?

It’s always a good time to learn more about Truist Business Lifecycle Advisory. Contact your Truist relationship manager to find out what’s available to meet your evolving needs.