Fast.

Enhance cash flow. No need to wait for a check to clear. Payments are sent directly to from their bank account to yours, typically within minutes.Disclosure 1

Safe.

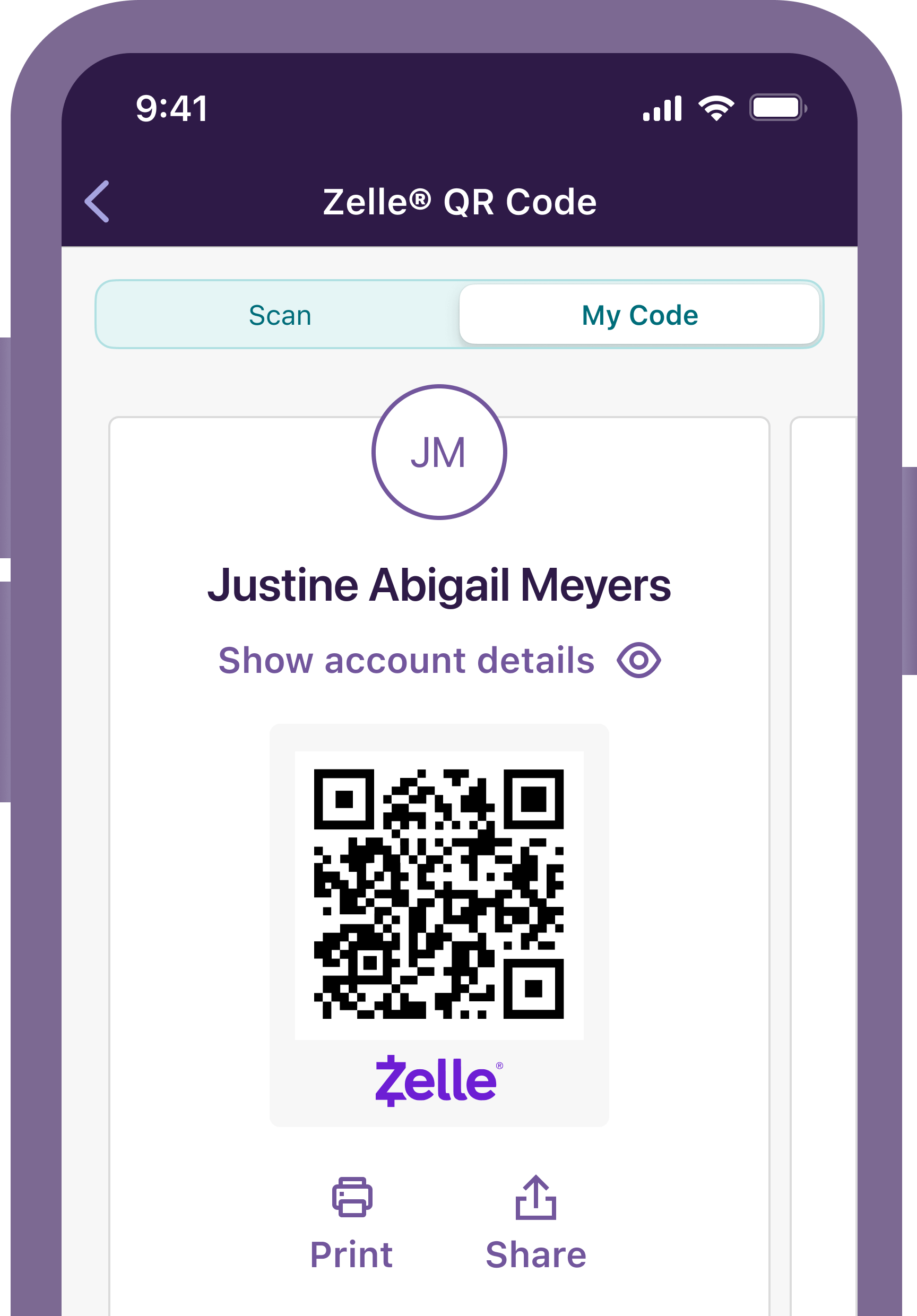

No need to provide your account information to send and receive paymentsDisclosure 1 with Zelle®.

Easy.

Your customers can pay you with Zelle® right from their banking app, so you can receive payments while on the go—no extra hardware required—and skip the trip to the bank.

Start your businessHow to hire and staff employees for your small business

Figure out how to staff your business, understand regulations, and get your payroll up and running

How To Hire & Staff Your Small Business | Truist

Master the art of hiring and staffing for your small business. Learn proven strategies to attract, select, and onboard top talent for growth and success.

Grow your businessThe secrets of growing businesses: How they’re finding success

Most businesses have experienced pressure from inflation, rising prices, and the economy. Yet some small businesses have been able to meet these challenges head-on.

What Growing Small Businesses Are Doing | Truist

Wondering what growing small business and industries are doing? Read this article to find what the next up and coming businesses are up to.

Start your businessWhy should my business use accounting and financial software?

Accounting and financial software can make your life easier. Automate recordkeeping, establish good bookkeeping habits, and connect your checking account to streamline your financial management.

Do I Need Accounting & Financial Software for My Business?

Accounting and financial software can make your life easier. Explore the benefits of automating record keeping, establishing good bookkeeping habits, and more.