The term “hedge fund” has been around since the 1940s. Today this way of investing can be misunderstood, but it’s worth learning about some of their potential benefits. Hedge funds offer a broad range of opportunities—but they may not be the right solution for everyone.

For properly accredited investors, hedge funds may enhance portfolios in many ways: by seeking to boost returns over the medium-to-long term, by minimizing downside risk, or by providing important overall diversification.

“Hedge funds can be very valuable, but they have a different risk profile and therefore require a different standard of work and diligence in vetting and overseeing them,” says Spencer Boggess, managing director of alternative investments at Truist Advisory Services, Inc.

There are a few key potential benefits to hedge funds. Atop the list is the access you may get to top investment management talent, Boggess says. Talented money managers often choose the hedge fund format because of its potential for greater investment flexibility and autonomy, and because the managers can invest and manage their capital alongside that of their clients, he says.

But this top talent also underscores two critical challenges of picking the right hedge funds: Performance differs significantly across hedge fund managers when compared to traditional investing, Boggess shares. There is also lower transparency from hedge funds—it can be difficult to learn whether the manager is following the fund’s stated strategy and risk profile, for example. This makes the selection of a hedge fund manager crucial, Boggess emphasizes. This brings us to the value of working with an experienced team that can navigate the required due diligence and ongoing monitoring.

The importance of hedge fund research

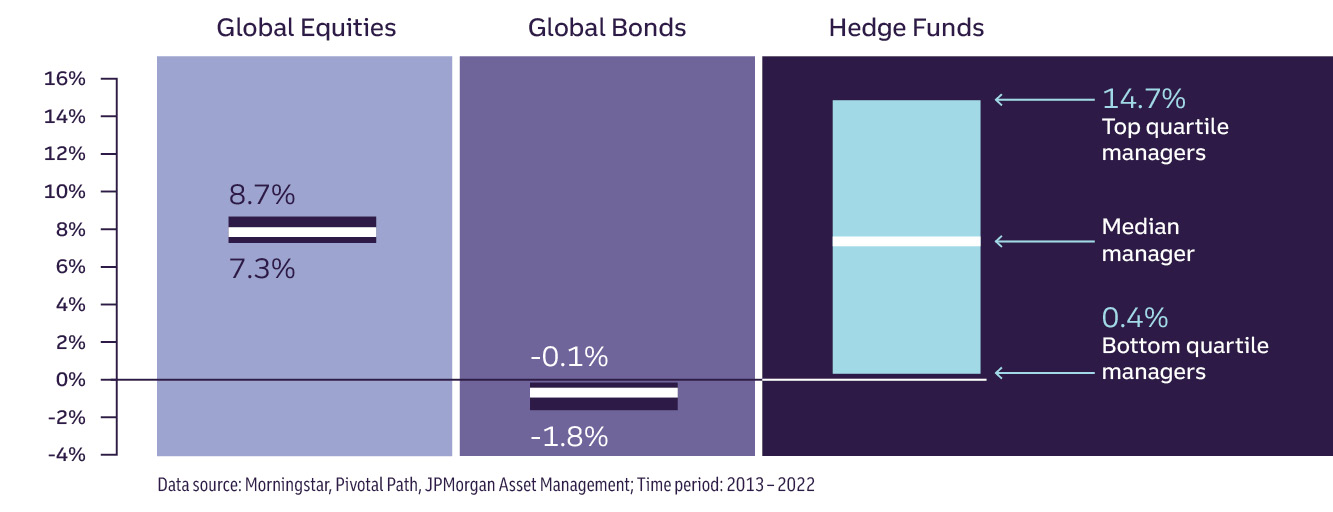

Navigating hedge funds on your own can be a challenge. Historically, the gap between the best- and worst-performing hedge funds is much wider than in other investment classes, making fund selection critical (see chart below). Expertise is needed to perform investment due diligence and assess the business and operations of the fund, Boggess says. It’s also important to monitor the fund on an ongoing basis once investments are made.

“We have to be completely confident that we’re making an informed decision about the quality and the integrity of the fund managers we’re working with,” he adds. “We spend a ton of time when we evaluate a manager—it’s probably about 200 hours of work.”

This is why Truist Wealth advisors like Margaret Wright turn to Boggess and his team to identify potential best-in-class funds for interested clients. Together, they can help clients better understand how hedge funds may fit into their investment portfolios. “If hedge funds are going to give my clients the best risk-adjusted return, then it should be part of the conversation,” Wright says. “Having these resources, we can go to that toolbox and educate our clients and educate ourselves. It’s that team approach that’s really important for us getting the proposal right.”

Investment managers’ performance dispersion

The difference between the best and worst hedge fund performers is enormous—far more than in other investment classes. This dispersion makes the manager selection process even more important.

Questions to discuss with your advisor

In addition to diligence, there are other questions to ask when considering hedge funds.

- What amount of investable assets do you have? Hedge funds are generally limited to accredited investors with the requisite high net worth.

- When will you need access to your money? Liquidity can vary. Many hedge funds offer quarterly liquidity with some restrictions, such as a multi-month notice period or waiting a year after the initial investment to redeem.

- Are you willing to pay the higher fees that come with hedge funds? Note that these fees have declined over time, with additional reductions possible based on investment size or more restrictive liquidity. Although their performance is evaluated on an after-fee basis, hedge fund fees are often higher than many other traditional investment offerings.

- Are you looking to be more aggressive in risk-taking and potentially achieve higher long-term returns, or are you more defensive and looking to potentially reduce the impact of market movements on your portfolio during volatile market periods?

“For investors interested in hedge funds, their individual investment goals and circumstances should be primary drivers of their hedge fund investing plan,” Boggess says.

Key hedge fund characteristics

- They use a variety of investment techniques across a range of global asset classes including equities, fixed income, credit, currencies, and commodities.

- Well-managed hedge fund firms usually focus resources on a single or limited number of strategies, which may lead to better performance. Hedge funds can have significantly different performance objectives—some seek to deliver large returns along with elevated risks, while others seek to be more conservative.

- Hedge funds are less regulated than mutual funds.

- While mutual funds are traded daily on exchanges, hedge funds are private investments that are less liquid.