Your family is unique, and so are your goals—and goal setting is an important component of your financial legacy. Has your family thought about what values you collectively hold and what goals you’re working toward? If not, now is the time to make those conversations part of your legacy planning to create a family mission statement together.

What is a family mission statement?

A mission statement is a written affirmation of your family’s values and priorities. An effective mission statement should address the core values and principles that will govern your family’s decisions, actions, and objectives. In doing so, you are solidifying your beliefs and goals. Consider it a connection point that acts as your family’s compass moving forward.

“Values, inherent in all of us, motivate behavior throughout our lives, establish our fundamental belief systems, and lie at the heart of all human relationships,” explain Carolann Grieve, managing director of Family Governance, and Daisy Medici, managing director of Governance and Education, Truist Wealth Center for Family Legacy, in their white paper “Mission statements for families of wealth: Identify the values and reap the reward.”

Their process begins by having individual conversations with family members about what matters most to them and then meeting together as a group to identify common values shared across your family. Keep it fun and light—you may just learn something about your kids or spouse that you never knew. These conversations require time and effort but can prove to be exceptionally rewarding later in life.

Here are three reasons why creating a mission statement can be beneficial to you and your family.

1. Preserve your family legacy.

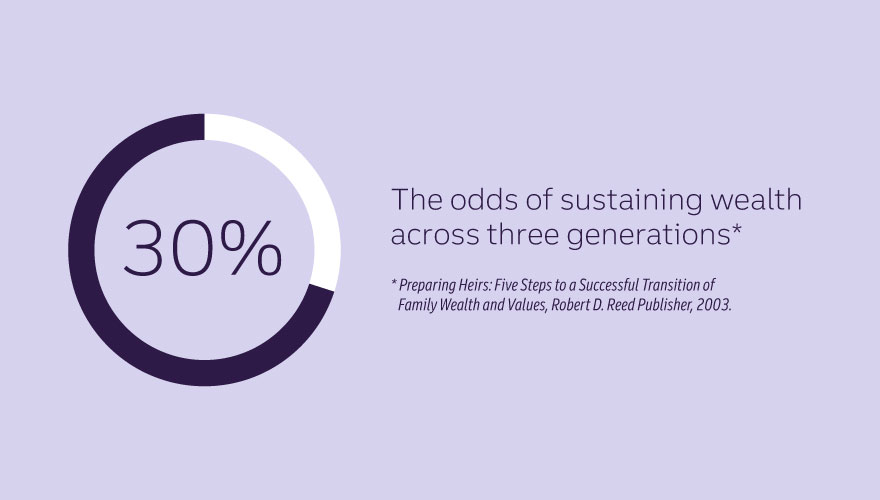

A family mission statement can be an essential navigation tool in wealth planning, particularly in light of wealth-transfer data: According to a 2003 study by Roy Williams and Vic Preisser, the odds of sustaining wealth across three generations are as low as 30%. Lack of communication or mission, unprepared heirs, and lack of strategic planning within the family can be contributing factors. Financial literacy and communication are key in transferring generational wealth to your kids. By creating a welcoming environment for open and honest communication, your family can stay better connected and work toward successful wealth preservation.

2. Get everyone on the same page.

For a mission statement to be successful, it must resonate for everyone within the family. Plus, allowing your children to have a seat at the table for the conversation is a great way to strengthen relationships and provide a learning opportunity for everyone involved.

“This open and honest communication between family members leads to greater trust, which helps prevent conflict,” say Grieve and Medici.

Everyone within the family must feel that their input is accepted and appreciated. But it’s important to not rush the process. In fact, the process can be just as important as the end result. It can be exceptionally gratifying, revealing, and productive to hear everyone’s point of view and to think through what values will drive your family’s decisions and choices.

3. Guide you through conflict and tough decisions.

“In the end, families will be rewarded with far more than a piece of paper,” say Grieve and Medici.

By creating a mission statement, you’re outlining your belief systems as a family unit in a way that’s clearly understandable to everyone. Should a tough conversation, decision, or conflict arise, you and your family can look back to your mission statement and remain true to your defined values to help guide your path forward. Consider your mission statement a covenant that preserves your family values and a compass that keeps your family on track to hit their goals.

To learn more about why family mission statements are beneficial in legacy planning, read Grieve and Medici’s white paper: “Mission statements for families of wealth: Identify the values and reap the reward.”