On our journey to obtain independence and achieve financial success, we usually prioritize having good educational experiences, a sound resume and a career with a nice salary. The reality is that even with all this, we can still face financial disaster if we don’t develop good financial habits. The road to financial freedom requires practice and discipline. Here are a few simple steps to aid you on your journey.

1. Start saving for your future...now!

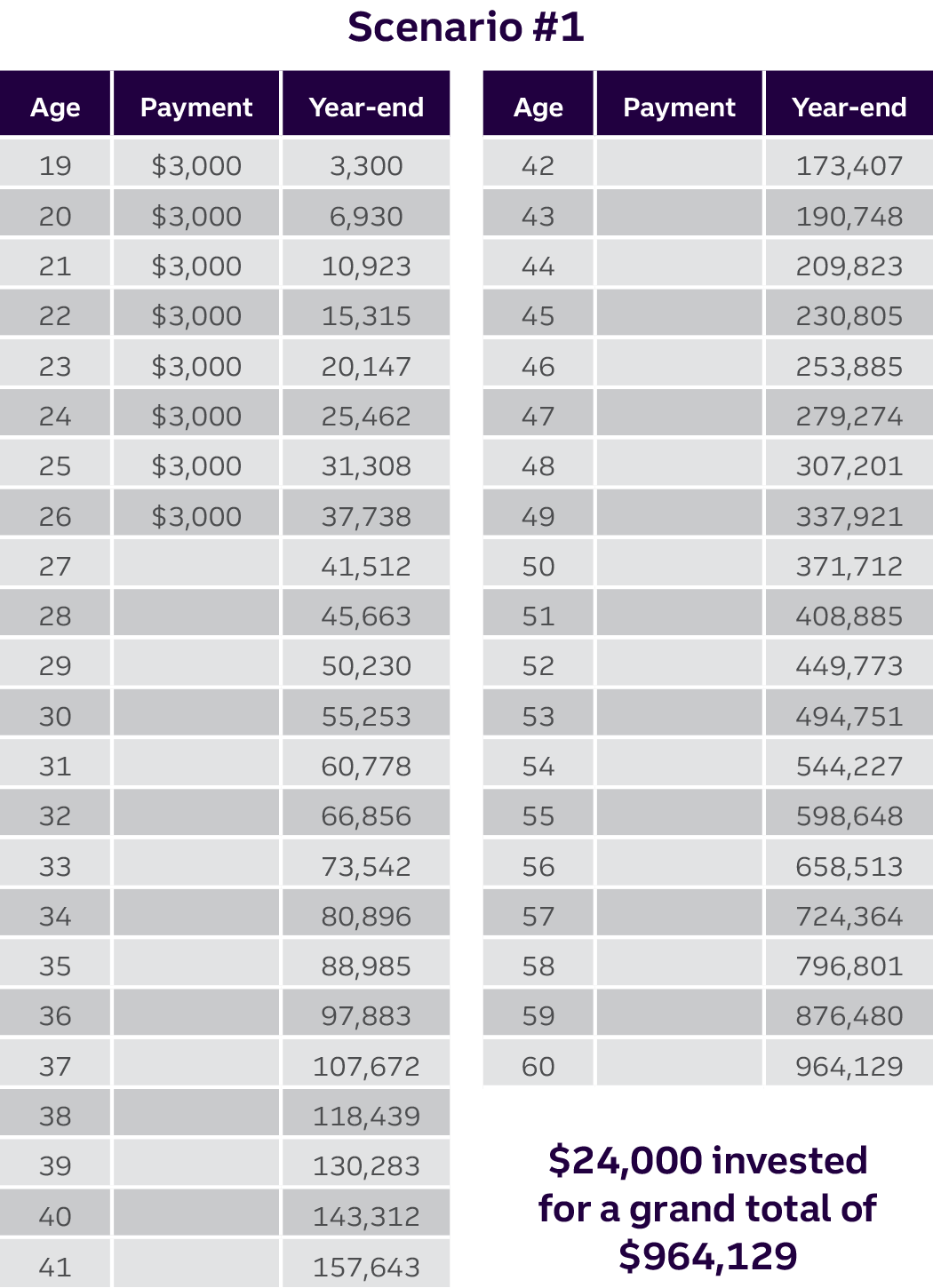

One in four people your age will live to be 100. If you want to retire at age 65 consider how you will have the money to live for the following 30+ years. It is critical to start putting money away now to prepare for your future. The power of compounding was deemed the 8th wonder of the world by Albert Einstein and timing is the key to maximizing its power. Check out the difference in the two individuals in the graphic on page 2 . The first invested a total of $24,000 over 8 years from age 19-26 then stopped investing. The second started investing at age 27 and over time contributed a total of $102K in their portfolio. The difference in their totals at retirement is solely due to when they started. Even if someone can only invest a small amount of money it is worth it in the long-run.

2. Get into the habit of budgeting — and stick to it!

Budget does not have to be a bad word and it does not have to require an extensive Quicken project. Budgeting, like brushing your teeth, eating healthy, and exercising, is all about getting into a habit. It is as simple as monitoring how much you make and how much you spend. Running out of money is never fun but it happens all too often. Keeping track of your spending can be a very eye opening experience (like realizing that a $5.65 latte enjoyed twice a week costs you over $500 a year) and small changes to spending habits can make a big difference. To start, collect all of your receipts for the week in a basket or your wallet or jot down expenses on your iPad. At the end of the week sit down with a calculator and add up how much is spent by category (eating out, shopping, rent, etc). Do this for four weeks and use the average spent in each category as your budget. If you end up with a negative balance (income–expenses) look at the categories to see what you can cut out. Monitor your spending on a monthly basis and change the budget as your life changes. This will allow you to take control of your finances and free up some extra money to start saving for your future.

Table Scenario #1

Table Scenario #1

Table Scenario #2

Table Scenario #2

3. Avoid debit cards and debt accumulation

Credit cards are not inherently bad. In fact, we all need to take on some debt to build a credit history. The key is to not pay unnecessary interest and fees to credit card companies. To do this only pay for things on a credit card that you can afford to pay back by the month’s end. Consider how the power of compounding works for you in #1 and think about how it works against you when it comes to credit cards. If you have a $1000 credit card bill charging 18% in interest and you decide to pay only the minimum payment guess how long it will take you to pay it off… 20 years! In addition, you will end up paying the credit card company over three times as much! Conduct research to find low interest credit cards in the event you cannot pay your bill off completely by month’s end. Also watch out for the teaser rates of 0% for a year. After that year is up you could end up paying 30% or more which really adds up fast! Look into cards that offer rewards, no annual fee and low interest rates. Most importantly, pay your bills! A poor credit rating can impact not only your ability to get an apartment, a car or house loan it can also impact your ability to get a job. If you do end up accumulating some unwanted debt, create a plan for how you will pay it off. Start by paying off the highest interest rate cards or loans first.

4. Bank smart

Bank smart by considering these tips:

- Use your bank’s ATM machine. Other banks will charge you a fee to use their machine and often you will get charged another fee by your bank. To withdraw $20 and get hit with $6 in fees makes very little sense.

- Make sure you know what minimums your bank has on your account. Some require a minimum balance or they will charge you a fee if you go under.

- Use the online bill pay function if it is available. It helps you monitor your expenses and allows you to set up automatic payments for fixed bills so you do not forget to pay them. Also you will save on stamps!

- Be aware of the implications of over drafting your checking account. Contact your bank to learn how you can protect yourself from overdraft fees.

- Do not leave too much money in a checking account that does not earn interest. Even if the interest rate you earn is small you might as well take advantage of earning money on your money by moving it into an interest earning savings account.

5. Have an emergency fund

It is important to be prepared for the “just in case” aspects of life. We recommend creating a savings account that accrues for an unexpected expense such as car repair, home repair, or a needed medical expense for you, your child or pet. This account may also be needed if you are faced with being laid off, which is unfortunately more common in today’s economy. Instead of racking up credit card bills it is important to have money set aside to cover your living expenses – we recommend having enough to hold you over for at least 3 months and ideally enough savings to last you 12 months. To help you accomplish this goal, each paycheck set up an automatic transfer from your checking account to your savings account. Often out of sight puts the money out of your mind until you really need it.

6. Learn about investing

Even if investing is not your passion and reading the Wall Street Journal or watching CNBC puts you to sleep, you would be wise to take the time to learn the basics. Even if you do not see yourself managing a large portfolio of assets or plan to have a financial advisor that does it for you, it is still critical to speak the language and have a foundational understanding. You will (hopefully) have a retirement investment account that you will need to make decisions about and these decisions should not be made by guessing or throwing darts at your options.

7. Set goals

In his book What They Don’t Teach You at Harvard Business School, Mark McCormack tells of a study of Harvard MBA students that asked, “Have you set clear, written goals for your future and made plans to accomplish them?” Only three percent of the graduates had written goals and plans. Ten years later, the members of the class were interviewed again, and the three percent who had clear, written goals were earning, on average, ten times as much as the other 97 percent put together. Take the time to write down your goals and aspirations- it will really pay off!

8. Take advantage of free money: invest in a company-matched 401k

Once you begin a new job, you may find your company offers a matching option when investing for your retirement. Many people in this situation are opting out of investing in a 401k and therefore essentially deciding to turn down a raise from their company. Let’s say that you make $50,000/year and your company provides a match on the first 5% of pay contributed. That means that if you are investing 5% of your income for retirement your company will also contribute 5%... so a difference of $2500 a year given to you by your company – essentially a 5% raise. Also if you have the opportunity to put aside money in a healthcare flexible spending account take advantage of it. The money you place in this account can be used for any medical expense and is taken from your paycheck before taxes. Imagine you spend $1000 a year on health care expenses and your average tax rate is 20% you could save yourself $200 per year.

9. Love your work

Psychologist Martin Seligman, in his book, Authentic Happiness found that people who describe themselves as happy (in their jobs) typically have better performance evaluations and earn higher incomes than those who said they were unhappy. Not enjoying your profession leads to additional stress, poor eating habits and health issues (all which will also cost you more money!) Plus you will likely spend more time at work than at home so you might as well do something that interests you and fits your skills.

10. Protect your assets

Make sure you have proper insurance to protect you and your assets. Car and health insurance are MUST HAVES. Gain knowledge around what insurance you do have and the costs. Make sure you have enough coverage and the appropriate deductibles. It may be surprising to learn if you are on your parents’ medical insurance that your doctor does not actually cost a $20 co-pay but instead costs a few hundred dollars made by your parents and their employer through paying for health insurance. Also consider other forms of insurance. Do you own or rent a home or apartment? Do you have content insurance for your home or apartment? Does your insurance cover floods? Do you have children or a spouse who would need to be cared for if something happens to you? Should you consider life insurance? Form a relationship with an insurance agent and assess your needs and coverage. Another important component to help you protect your assets is having your basic estate planning documents in place. You should have the following planning documents wishes should you be medically incapable of making decisions on your own. A financial power of attorney is the formal selection of a person you determine will make financial decisions on your behalf if you were unable to do so and a health care power of attorney is naming the person who would be deemed the decision maker on your health care needs. Having these documents in place will help to protect you and your family.

Conclusion

The road to achieving financial freedom likely contains u-turns, bumps and dead ends. It is very tempting to live beyond your income but the consequences can negatively impact your life for years to come. Be smart about your spending, have patience and save for the things you want, invest for your long-term future and be careful with taking on debt. Follow these recommendations, stay on course and you will reach your destination.

Thank you to the contributions from women who attended GenSpring’s Women’s Retreat. Many of the suggestions were directly gleaned from their personal experience of getting a prenuptial agreement or working with their children on the importance of having a prenuptial agreement.

Talk to a Truist Wealth advisor or reach out to Truist Wealth’s Center for Family Legacy for more information.